“Jesse Livermore”

So wrote Jesse Livermore, as chronicled in the brilliant book Reminiscences of a Stock Operator by Edwin Lefevre. Stock market historians will recall that Jesse Livermore is still considered one of the most colorful stock market speculators of all time. Indeed, the “boy plunger” was blamed for the market crash of 1929 and for precipitating every market swoon from 1917 to 1940. Jesse’s investing success was driven by his ability to develop certain indicators, combined with an investing discipline that spawned such stock market axioms as:

- Fear your losses and let your profits

- It never was my thinking that made me money, but my sitting

- Markets are never wrong, opinions

- The tape knows

Years ago we studied the tactics of Jesse Livermore, along with a number of other stock market operators, and have found many of those strategies to be just as valid today as they were decades ago. We were reminded of the Livermore “pearls” while reading an interview with stock market guru Stan Druckenmiller who said:

These algos (algorithms) have taken all the rhythm out of the market and have become extremely confusing to me. And when you take away price action versus news from someone who’s used price action news as their major disciplinary tool for 35 years, it’s tough, and it’s become very tough. I don’t know where this is all going. If it continues, I’m not going to be able to return to 30% a year any time soon.

The implication was that almost every meaningful indicator Druckenmiller used to follow markets no longer works. “People, and institutions, simply are not trading or investing the way they used to. It’s part and parcel of how dramatically the business has changed, and of the ways so many hedge funds and trading desks work these days.” To us, those comments were akin to Jesse’s quote, “There were times when my plans went wrong and my stocks did not run true to form, but did the opposite of what they should have done if they kept regard for precedent.”

We, however, take exception to the quote “People, and institutions, simply are not trading or investing the way they used to. It’s part and parcel of how dramatically the business has changed, and of the ways so many hedge funds and trading desks work these days.” We actually think the individual investors/traders have a HUGE advantage to the institutional types. For example, if we want to buy, or sell, 1000 shares of a stock, we can do so easily. Not so a portfolio manager that wants to sell 100 million shares of Facebook (FB/$131.73/Outperform). At the end of this missive we include Jesse Livermore’s trading rules, which we consider to be just as valid today as they were nearly a century ago.

As for the here and now, we called the decline with our October 2, 2018 trading “sell signal,” where we said to reduce speculative trading positions. Unfortunately, I did nothing with investment positions and in retrospect I wish I had. Andrew Adams identified the October 29 trading low on the S&P 500 (SPX/2632.56) at ~2603, which we said to buy on a trading basis, and we wrote that the subsequent “throwback rally” should carry the SPX back into the 2800 – 2820 that would contain the rally followed by a secondary decline whose low would be above the October 29 trading low. We are about to see if that “call” is correct this week when the pros return from vacation. Speaking of “pros,” we were intrigued by one of Wall Street’s best and brightest, namely Joe Monaco eponymous founder and portfolio manager of Monaco Capital, who wrote us over the weekend. To wit:

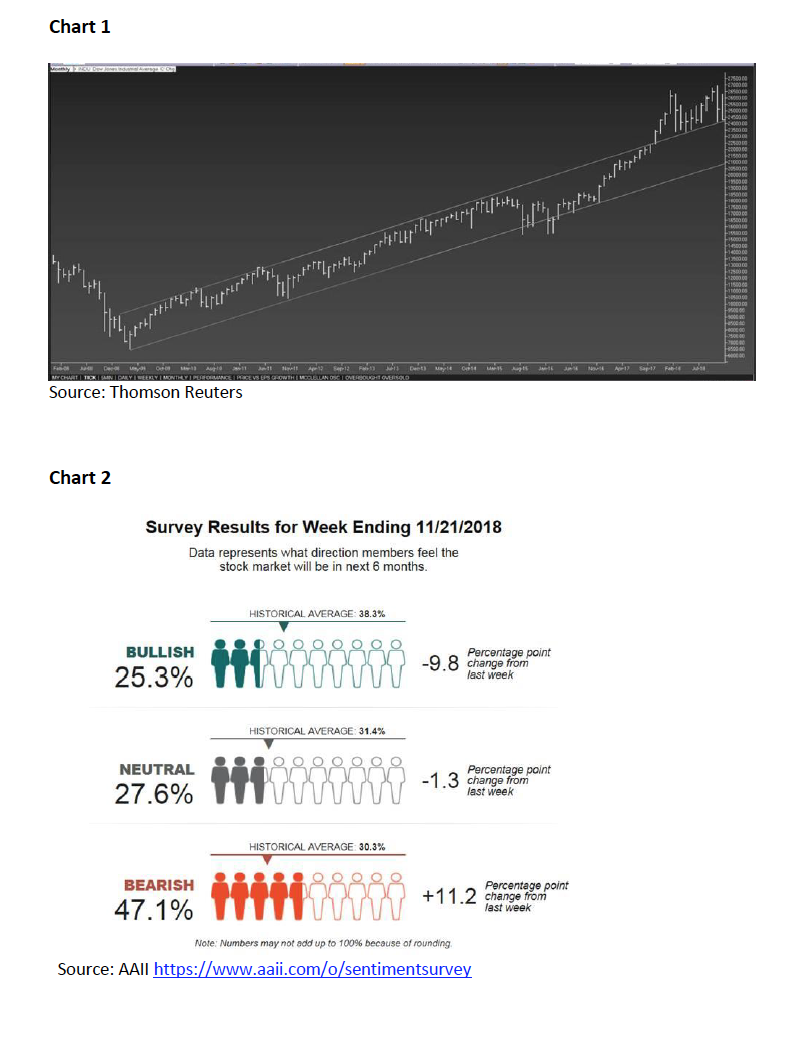

Just doing some work on Saturday morning and pulled up this monthly chart of the Dow. We certainly were in a very clear channel since 2009 and we have come down to what used to be the resistance line. I would think this is about where we would stop and turn around. I was surprised though to see such a clear channel during this bull market and the clear breakout [Chart 1].

Of course, this concurred with our pal market wizard Leon Tuey, who writes:

Happy Thanksgiving, indeed! Last night, the AAII Investor Sentiment Survey was released and the numbers are super bullish! Bears outnumbered bulls by a margin of nearly 2-to-1. That is very bullish for the stock market. Also, when the BULLISH reading drops to 30% or lower, the market is at a low-risk, high-reward juncture point and readings of 25% or lower, you can bank on it [Chart 2].

Leon goes on to write:

But look at the monthly chart of the S&P 500 [Chart 3]. In terms of time and magnitude, the recent correction is nothing like the corrections in 2010, 2011, or 2015-2016. Yet, many are foaming at the mouth thinking it’s the end of the world. The most popular refrain is “the market will test the October low” and the bears are predicting new lows. As mentioned before, the pundits never seem to understand why God gave us two ears and one mouth. They don’t realize that the correction was nothing more than a normal reaction to a short-term overbought condition, a correction within the confines of an ongoing bull market. Frightened by the black headlines and the market gyrations, however, their brain went foggy, their vision impaired, and their bodily malfunctions seized up, (a difficult state to be rational) they don’t realize that “the market” already bottomed. Fear keeps them on a bearish track.

The call for this week: So far the trading pattern has been just about perfect with the S&P 500 declining from the envisioned overhead resistance at 2800 – 2820 amid cries of recession, crash, bear market, etc. It is stunning to us at this stage of a secular bull market, and a very bullish chart pattern, that so many pundits are scared to death! We have long targeted mid- November as a turning point for the various markets for a variety of reasons often mentioned in these missives. So if the SPX drops down to the reaction low of October 29, 2018 at 2603, or even a downside overshoot to an undercut low, it should set the stage for the next big rally into year’s end. We are now within the timeframe for a double-bottom around the 2600 level basis the SPX, which should act as a springboard for the yearend rally. Moreover, the Operating Company Only Advance- Decline Line is well above its October 29, 2018 lows and the money flows indicator are showing signs of accumulation (Chart 4). Rather than attempting to buy individual stocks, we like the idea of buying some sort of S&P 500 index vehicle for trading accounts with a 2593 stop-loss point. Please print out the following trading rules written by Jesse Livermore in 1940 because they are just as valid today as they were nearly 70 years ago! This morning, Brexit looks better, President Trump threatens to close the Mexican border, Russia fires at three ships in Crimea, Trump and Xi signal readiness for trade talks as the G20 begins, leaving the preopening futures S&P 500 better by some 30 point. Like we said last week BUY . . .

More than 70 years later, these are rules every trader needs to keep in mind:

- Nothing new ever occurs in the business of speculating or investing in securities and commodities.

- Money cannot consistently be made trading every day or every week during the year.

- Don’t trust your own opinion and back your judgment until the action of the market itself confirms your opinion.

- Markets are never wrong – opinions often are.

- The real money made in speculating has been in commitments showing in profit right from the start.

- At long as a stock is acting right, and the market is right, do not be in a hurry to take profits.

- One should never permit speculative ventures to run into investments.

- The money lost by speculation alone is small compared with the gigantic sums lost by so-called investors who have let their investments ride.

- Never buy a stock because it has had a big decline from its previous high.

- Never sell a stock because it seems high-priced.

- I become a buyer as soon as a stock makes a new high on its movement after having had a normal reaction.

- Never average losses.

- The human side of every person is the greatest enemy of the average investor or speculator.

- Wishful thinking must be banished.

- Big movements take time to develop.

- It is not good to be too curious about all the reasons behind price movements.

- It is much easier to watch a few than many.

- If you cannot make money out of the leading active issues, you are not going to make money out of the stock market as a whole.

- The leaders of today may not be the leaders of two years from now.

- Do not become completely bearish or bullish on the whole market because one stock in some particular group has plainly reversed its course from the general trend.

- Few people ever make money on tips. Beware of inside information. If there was easy money lying around, no one would be forcing it into your pocket.